Military-like industrial displays are experiencing steady growth, driven by increased demand in sectors like aviation, rugged tablets, smart vehicles, and drones. These specialized displays, used across verticals such as transportation, smart retail, and medical, are designed to endure harsh environments and extreme conditions, Omdia report said.

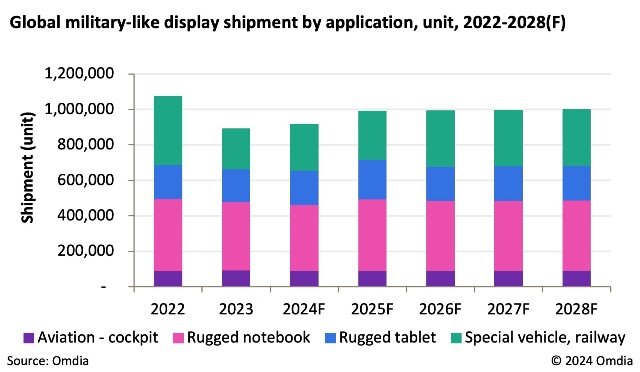

Omdia forecasts that global military-like display shipments will reach 916,000 units in 2024, marking a 2.8 percent year-over-year (YoY) growth, with further expansion to 989,000 units by 2025. This growth trajectory is expected to continue, with shipments surpassing one million units by 2028.

Tianma and Innolux lead the global market, controlling 78 percent of the military display sector.

Innolux dominates aviation displays with panels between 3.1 to 7 inches, which account for 40 percent of the shipment share in aviation-related applications.

Tianma is the primary supplier for rugged tablets and notebooks, which require robust displays that can withstand demanding military and industrial environments. For instance, 10.1-inch displays are prevalent in rugged tablets, while 13.3-inch screens dominate rugged notebooks.

Drones are also becoming an increasingly important part of military operations, with manufacturers developing rugged tablet displays (10.1 inches) and ground station screens (15.6 inches) to support remote control operations. Panel makers are also creating cost-effective open cells in the 5 to 7-inch range to meet the growing demand for drone displays.

Analysts predict potential supply chain shifts as geopolitical conflicts continue to evolve, potentially impacting future supply chain relationships. However, with major players such as Tianma, BOE, and Innolux leading the way, the market for military-like displays is expected to remain robust in the coming years.